Custom Coded Behaviours and Features

Overview

This page is to show the various templates and action definitions with custom code behaviours.When

Statutory newDeclaration (Stat Dec) Actions

We - Definition

Threeforyearstenementsinthat can be loaded into LandTracker.

This action definition is used to auto-generate thepast - follow

Fiveupyearsstatindec action for an Exemption from Expenditure (WA), which is due 28 days after thefuture,exemptiontofromaexpendituremaximumformofisfivelodged.The

futuredeadlineactionsdateandforminimum of one futurethis action(evenwillifbethat28onedays after the Exemption Lodged Date.NOTE: This action is

dueonlyaftercreatedfivewhenyears'antime).TheExemptiondefaultLodgednumberDateofispast,foundfuture andfrom themaximumdatanumberreturnedofbackfuturefromactions to create can be overridden inApplication SettingsMTO..

You can update actions for all assets at once, or limit the update to specific asset types.

Stat Dec Actions

Update / Audit Actions is used to recalculate all actions and provide an audit report with the ability to save new and modified actions.To Update:

- Open an Update / Audit All Actions window. The link to use will depend on whether you want to update all actions, or just those for a specific asset type.

- To update actions for all asset types, select Update / Audit All Actions

from the Dashboard.

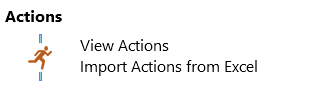

Dashboard Actions Menu

Dashboard Actions Menu - To update actions for just Tenements and Combined Reporting Groups, click the Update / Audit Tenement Actions

link in the Tenements module on the dashboard.

Dashboard Tenements Menu

Dashboard Tenements Menu - To update actions for just Agreements, click the Update / Audit Agreement Actions

link in the Agreements module on the dashboard.

Dashboard Agreements Menu

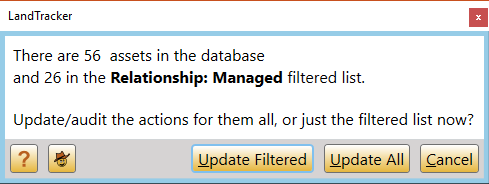

Dashboard Agreements Menu - This will display a message box informing you of how many assets (e.g. tenements, combined reporting groups and agreements) are in the current Global Filter and whether you would like to proceed with the update of their actions.

Update Confirmation Message

Update Confirmation Message -

will close the message box and take you back to the dashboard.

allows you to only update actions for the Assets in the current Global Filter, while is used to update actions for all assets in your copy of LandTracker.

Note: When a Global Filter is selected, Combined Reporting Group actions will only be updated if the CRG is a member of the Global Filter's group. For example, when filtering for the Big Wheelbarrow project group, you should include both the Tenements and their CRGs in the Big Wheelbarrow group. - As the update runs, its progress is displayed. Note that you cannot perform any other actions in LandTracker until the update is complete.

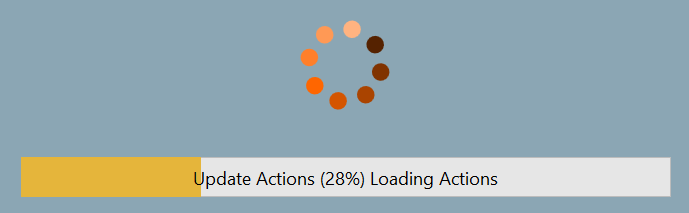

Progress Message

Progress Message

You can also see the progress at the bottom right of the screen.

- You will be presented with the Change Tracking window which will display which actions will be created, updated or deleted.

Refer to the Change Tracking wiki page for more information on this window.

Future Actions are deleted if they are no longer applicable, for example when a tenement dies.

However, to avoid deleting data that you require, the update process does not delete Actions that have been completed, are overdue or have already been commenced - at least one Task has been ticked. You can manually delete these Actions if they are no longer required. - If you click

on the Change Tracking acceptance message, LandTracker will save the changes to the database, and take you back to the dashboard.

To see when an update was last performed, and what changed, see Review Audit / Update History

Amount field in Rent actions

When Rent actions are created for Western Australian tenements, the Amount is calculated as per the DMIRS fees and charges schedule, with an additional CPI increase added to the calculation for future years. The CPI percentage used can be customised in Application Settings.